United Way of the Greater Capital Region and Partners Launch 2024 Volunteer Income Tax Assistance (VITA) Program

United Way, Catholic Charities and partners are urging Capital Region residents to become volunteer tax preparers with the VITA program, which helps local families and individuals save millions of dollars in filing fees and receive millions more in eligible tax credits.

LATHAM, NY, January 26, 2024 | During a Friday morning press conference at Catholic Central School in Latham, United Way of the Greater Capital Region (UWGCR), Catholic Charities of the Diocese of Albany and their partners in the Greater Capital Region CA$H Coalition kicked off the 2024 Volunteer Income Tax Assistance (VITA) season.

Peter Gannon, CEO & President at United Way GCR

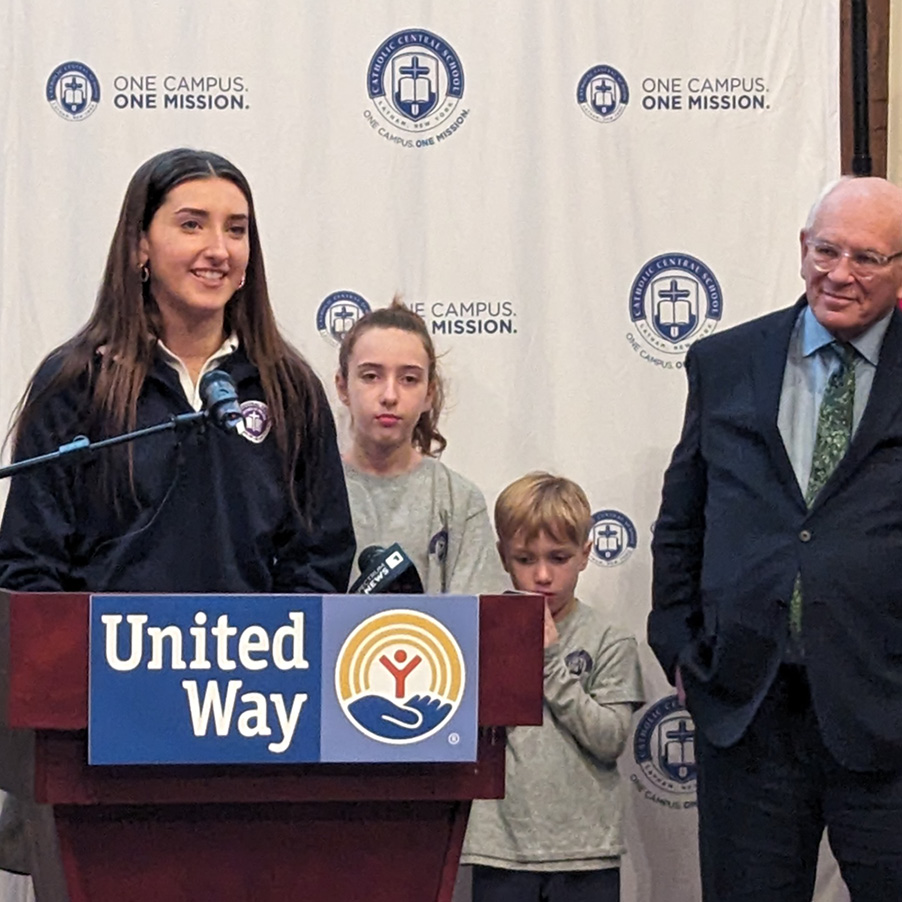

Congressman Paul D. Tonko & Catholic Charities VITA Students

Yolanda Weaver, Federal Goverment at Internal Revenue Service

An IRS-sponsored program, VITA is a free service that offers thousands of Capital Region families and individuals a completely safe and secure way to file their taxes each year. In 2023, more than 4,800 Capital Region residents filed their taxes through VITA, receiving nearly $7 million in refunds and saving $1.44 million in filing fees. The average income for last year’s VITA filers was $30,382. Families and individuals who earn less than $60,000 per year are eligible to file through the program.

“VITA is a critical tool for individuals and families in our Capital Region and beyond, providing free tax preparation assistance for those who need it most,” said Representative Paul Tonko (NY-20). “I’m grateful to the CA$H Coalition and United Way of the Greater Capital Region for organizing today’s event, and I’m thrilled to join them in their effort to raise awareness of these important resources.”

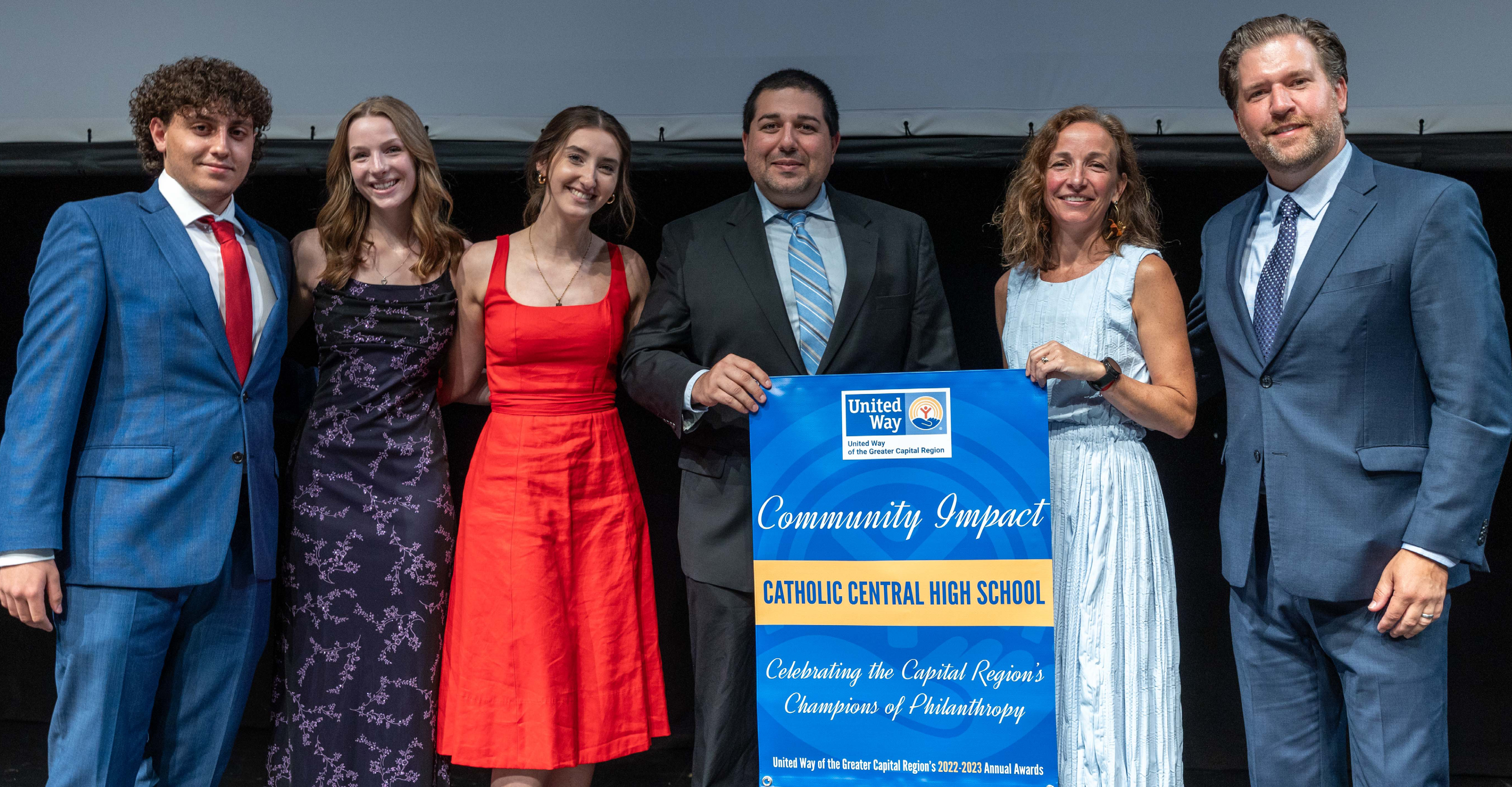

Catholic Central School students received the 2022-23 Community Impact Award at United Way's Annual Awards.

To highlight the program’s importance, stakeholders were joined by students from Catholic Central School, which has been a VITA partner for over 20 years. In 2023, the students – who have been certified by the IRS - helped prepare more than 300 returns, saving local families nearly $100,000 in filing fees. In recognition of their contributions to the VITA program and the individuals it benefits, UWGCR honored the students with the Community Impact Award at its Annual Awards Celebration last June.

“VITA is critical to low-income families who receive a temporary income boost from their returns and refundable tax credits,” said Peter Gannon, UWGCR President & CEO. “We couldn’t be more proud and more appreciative of our partnership with the students at Catholic Central School, who are helping local families save thousands in filing fees and claim more of their own hard-earned money.”

“The VITA Program provides critical, and accurate, free tax preparation services across the Capital Region, saving each client hundreds of dollars in tax prep fees,” said Jennifer Hyde, Executive Director of Catholic Charities of the Diocese of Albany. “The program returns millions of dollars each year to the Capital Region and provides clients with the knowledge to prepare for their taxes the following year. Catholic Charities is proud to partner with United Way of the Greater Capital Region to provide this service.”

Emily Wheland, Senior at Catholic Central Schools

Jenn Hyde, Executive Director at Catholic Charities, Tri-County

Peter Crummey, Colonie Town Supervisor

The VITA kickoff was held on the IRS’s 18th Annual Earned Income Tax Credit (EITC) Awareness Day. In 2023, Capital Region residents who filed through VITA received roughly $1.48 million back in Earned Income Tax Credits and $1.28 million in Child Tax Credits. Despite the importance of EITC and CTC to families, the IRS estimates that 20% of people or families eligible for the EITC aren’t claiming it on their returns. To ensure local filers receive all the money they’re eligible for, VITA volunteers are specifically trained to determine who qualifies.

“By providing an opportunity for taxpayers to get free tax help, the IRS’s VITA Program supports communities across the country and delivers services to many underserved communities, including the working homeless,” said Sharen Moore, a Local Taxpayer Advocate for the IRS. “As a Taxpayer Advocate, I am proud to support the VITA program and help bring awareness to everyone in our community. I’ve worked with VITA to assist homeless individuals make steps toward independence, by assisting in obtaining honest refunds, for free. VITA helps the IRS be the community organization we strive to be.”

FREE tax preparation is available at 18 sites in Albany, Columbia, Greene, Montgomery, Rensselaer, Saratoga, Schenectady, and Schoharie counties. Residents can view the full list of locations and book their appointments at GetFreeTaxPrep.org or file on their own at MyFreeTaxes.com. Many sites offer same-day and virtual preparation or a combination of both.

During Friday’s press conference, VITA partners highlighted the growing need for more volunteer tax preparers. All volunteers will be trained and no past experience is necessary. Anyone interested in volunteering this year is asked to email VITA Program Coordinator Andrew Kochian at andrew@unitedwaygcr.org.